Markets Rebound as Inflation Cools Sharply, Lifting Rate Cut Hopes

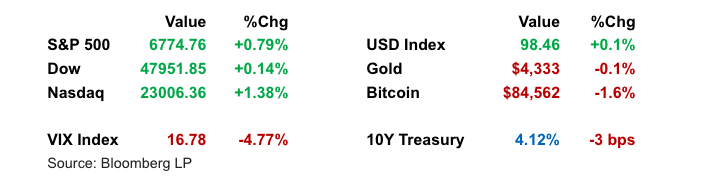

Stocks rallied Thursday after a surprisingly soft November CPI report reignited optimism around disinflation and a more accommodative Fed in 2026. The S&P 500 and Nasdaq snapped a multi-day losing streak, helped by sharp gains in tech and AI-related names. Treasury yields fell, and markets grew more confident in the case for future rate cuts, though near-term Fed policy remains uncertain given data distortion concerns tied to the recent government shutdown.

Key Headlines & Market Movers:

- CPI Surprise Rekindles Dovish Fed Expectations: Core CPI rose just 2.6% year-over-year in November, well below the 3.0% consensus and marking the slowest pace since early 2021. While the report’s credibility was clouded by data collection delays from the shutdown, the direction of travel in inflation was clear and welcomed by markets. Analysts cautioned that the Fed is likely to wait for cleaner December data before making any policy decisions, but the report adds weight to the argument for cuts by mid-2026.

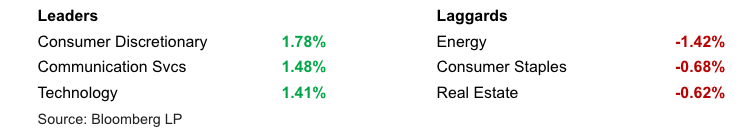

Micron Fuels AI Sentiment and Tech Rebound: Micron shares jumped 11% after posting strong earnings and an upbeat outlook tied to surging AI demand. The results helped lift the entire semiconductor space, with Nvidia and AMD each gaining 2%. Broader enthusiasm for AI rebounded following recent selling pressure, and megacap tech outperformed, pushing the Nasdaq up 1.6%. While enthusiasm remains high, concerns linger over the narrow breadth of leadership and elevated valuations in the sector.

- Global Central Banks Deliver Mixed Messages: While U.S. yields declined, European bonds underperformed after the ECB and Bank of England struck a more hawkish tone, highlighting global divergence in rate expectations. The Fed’s next move is still up for debate, but foreign central banks appear less eager to pivot. This divergence kept the U.S. dollar steady and contributed to mixed performance in global fixed income markets.

Notable Corporate Moves and M&A: Trump Media surged nearly 40% after announcing a $6 billion all-stock merger with fusion energy firm TAE Technologies. Other corporate highlights included Darden raising guidance on strength from higher-income diners, and activist Elliott building a $1B stake in Lululemon. Meanwhile, SoFi launched a USD stablecoin and Chevron began exporting Venezuelan crude amid political scrutiny, showcasing growing diversification and geopolitical complexity across sectors.

S&P 500 Sector Performance

Looking Ahead

While Thursday’s inflation report supports a growing disinflation narrative, the Fed is unlikely to shift decisively before seeing the more complete December CPI in January. Markets are increasingly pricing in rate cuts by mid-year, but policymakers remain cautious. With valuations stretched and AI leaders driving the bulk of equity gains, upcoming macro data and earnings will need to confirm the durability of this rally. For now, the path of least resistance into year-end appears upward, but risks around inflation credibility, global policy divergence, and narrow market leadership persist.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.