Markets Rebound from Intraday Lows as Broader Rotation Gains Momentum

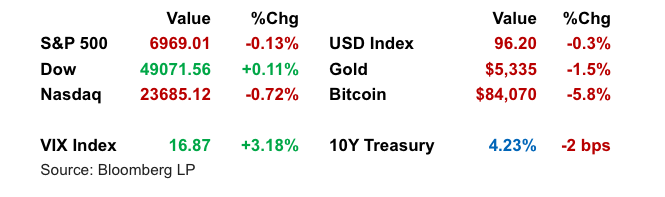

Dip buyers reemerged Thursday after early-session weakness, helping markets claw back losses triggered by renewed skepticism around AI-driven tech spending. Mixed earnings from key tech names fueled volatility, with Microsoft dragging the S&P 500 and Nasdaq lower despite overall resilience in economically sensitive sectors. Meanwhile, commodities diverged as oil spiked on geopolitical tensions and gold retreated from record highs.

Key Headlines & Market Movers:

- AI Trade Faces Scrutiny, But Rotation Is Taking Hold: Microsoft’s 10% drop underscored growing investor impatience with the timeline for AI monetization. Despite strong top-line results, slowing cloud growth stoked doubts about near-term returns on aggressive AI investments. In contrast, Meta’s upbeat guidance and 10% surge reassured markets that spending can pay off with a clear strategy. The broader theme: a cautious recalibration of the AI narrative is underway, pushing investors to diversify beyond the megacaps.

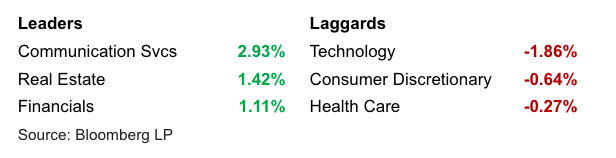

Broader Market Rotation Gains Steam: Value and cyclical names outperformed as small-cap and industrial stocks saw renewed interest. Earnings from Caterpillar, Honeywell, IBM, and Southwest Airlines beat expectations and highlighted demand tied to real economy activity. This supports the ongoing shift away from growth concentration, particularly as earnings forecasts for the Magnificent Seven are expected to moderate through 2026.

- Commodities Diverge Amid Geopolitical Jitters: Crude oil jumped over 4% as tensions escalated between the U.S. and Iran, pushing Brent back above $70. Meanwhile, gold gave back gains after briefly touching a new high near $5,600. Despite the pullback, elevated precious metal prices suggest lingering demand for safe-haven assets amid market crosscurrents and geopolitical unease.

Market Volatility Rises Post-Fed, With Eyes on Apple: The day after the Fed left rates unchanged, markets showed increased sensitivity to earnings surprises. Tech volatility dominated as software names like Atlassian and ServiceNow sank on guidance concerns. Apple’s report today will be key in shaping sentiment around the AI trade and Mag 7 leadership. Notably, Microsoft, Meta, and Tesla’s post-earnings divergence highlights investors’ growing emphasis on monetization clarity and near-term growth paths.

S&P 500 Sector Performance

Looking Ahead

The AI boom remains a key market driver, but the trade is maturing. With expectations now baked into valuations, investors are becoming more selective, rewarding firms showing clear monetization and penalizing those without. This shift opens the door for a broader market participation story in 2026 led by cyclicals, value names, and under-owned sectors like financials and industrials. Apple’s results will be a key inflection point, while bond markets and geopolitical developments continue to shape macro sentiment. As earnings season accelerates, the balance of risk appears to favor stock pickers over index chasers.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.