Stocks Rebound as Manufacturing Surges; Rate Cut Bets Pushed Back, Gold Slumps

Stocks rebounded with support from unexpectedly strong manufacturing data, halting a recent losing streak. Cyclical sectors and small caps led the rally, helped by optimism that U.S. industrial activity is finally regaining momentum. Meanwhile, bond yields rose and commodities, especially gold and oil, tumbled, signaling a shift in positioning amid evolving rate expectations and geopolitical recalibration.

Key Headlines & Market Movers:

- Factory Rebound Sparks Optimism: The ISM Manufacturing Index jumped to 52.6, its first expansionary reading in over a year, beating every economist forecast. This points to strengthening demand and hints that U.S. industry may be turning a corner after years of stagnation. While survey commentary remained cautious, the headline data supports the narrative of a “Goldilocks” economy with stable growth and restrained inflation.

Bonds Drop as Rate Cut Bets Repriced: Treasuries sold off, pushing the 10-year yield to 4.28%, as traders dialed back near-term rate cut expectations. The stronger manufacturing report and comments from Fed officials, including Raphael Bostic who sees no cuts in 2026, signaled the Fed may hold steady longer than markets anticipated. Futures now price the next cut for July.

- Gold Crashes, Then Stabilizes: Gold and silver were hit by a sharp unwind in speculative positioning, with spot gold dropping nearly 5%. The move follows Donald Trump’s mention of Kevin Warsh as a potential Fed Chair, perceived as hawkish. Analysts caution this is more about sentiment than fundamentals, as some investors rotate out of precious metals after a parabolic rise.

Earnings Momentum Supports Broader Rally: Despite Disney’s weak forecast, corporate earnings momentum remains strong. Over half of companies reporting 2026 EPS have beaten analyst expectations, well above historical norms. Strategists at Goldman Sachs and Morgan Stanley point to strength in value, small caps, and consumer discretionary names, suggesting opportunities beyond the megacap tech trade.

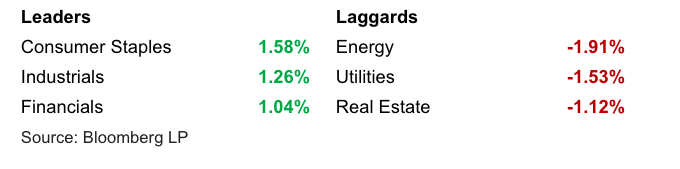

S&P 500 Sector Performance

Looking Ahead

The absence of Friday’s jobs report due to the government shutdown may leave markets more sensitive to alternative data and Fed commentary in the coming week. Investors will watch closely for signs of follow-through in manufacturing and any emerging cracks in the inflation narrative as positioning remains barbelled between risk-on equities and defensive hedges.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.