Tech Rally Stalls as Caution Rises Amid Geopolitical Tensions and Shutdown Uncertainty

Markets capped the week with modest gains but closed mixed on Friday as a late-day selloff in tech erased earlier momentum. The S&P 500 eked out a small gain to log a third consecutive record close, while the Nasdaq slipped as Palantir’s sharp decline weighed on the index. Optimism around AI and rate cuts remains, but investor sentiment is showing signs of fatigue amid growing geopolitical risks, mixed economic signals, and a government shutdown now in its third day.

Key Headlines & Market Movers

- AI Optimism Meets Reality Check: A flurry of high-profile AI deals earlier in the day, including a $40 billion data center acquisition and new partnerships involving Hitachi, Fujitsu, and Nvidia, initially pushed tech stocks higher. However, growing skepticism over valuations and lack of near-term profits triggered a late-day reversal. OpenAI’s $500 billion valuation and ongoing investor enthusiasm are raising concerns of froth, especially with sentiment indicators approaching “manic” levels.

Geopolitical Tensions Weigh on Risk Appetite: President Trump’s warnings to Hamas over the Gaza conflict and threats to pull federal funding from Democratic strongholds injected fresh political uncertainty. The hawkish tone came as the shutdown entered day three, complicating economic policymaking and clouding the near-term outlook. Treasury pricing now reflects expectations for a prolonged shutdown potentially lasting up to a month.

Economic Signals Turn Softer: With the BLS jobs report delayed, private-sector data painted a picture of a cooling labor market, limited layoffs but tepid hiring and wage gains. Meanwhile, the ISM Services Index contracted for the first time since the pandemic, highlighting cracks in economic resilience. Despite the data vacuum, swaps markets are pricing in another Fed rate cut in October, even as Fed officials remain split.

Defensive Assets Outperform as Gold Shines: Gold posted its seventh straight weekly gain, outperforming tech stocks year-to-date. Central bank buying and lower real rates have supported the metal, even as AI hype dominates headlines. Crude oil rebounded Friday after Trump’s Middle East remarks, though it still ended the week below $61/barrel. The dollar weakened for the week, marking its worst stretch since August.

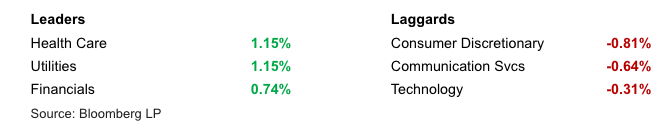

S&P 500 Sector Performance

Looking Ahead

Investor focus will shift to incoming corporate commentary and private data sources as the government shutdown delays key releases. With the Fed decision later this month, markets will be parsing alternative indicators for evidence of cooling inflation or labor market weakness. Meanwhile, geopolitical developments and continued AI deal activity will remain central to sentiment, though rising caution suggests the recent tech-led rally may be due for a breather.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.