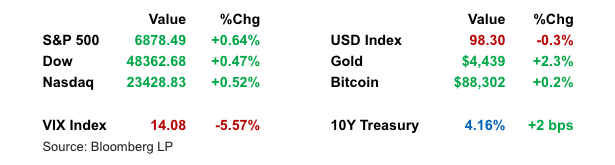

U.S. equities extended their year-end rally to kick off the holiday-shortened week, with broad gains across sectors and the S&P 500 brushing against record highs. Tech leadership remains firmly intact, driving optimism for a “Santa Claus rally” to close out a volatile but ultimately strong year. Treasury yields ticked slightly higher, while gold and silver soared to record levels amid geopolitical tensions. Investor sentiment appears firmly risk-on, with fund managers trimming cash and increasing equity exposure into year-end.

Key Headlines & Market Movers:

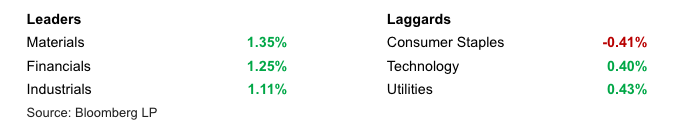

- Tech Strength Fuels Broader Gains: Tech megacaps led the market higher again, helping the S&P 500 reverse December losses and move toward an eighth consecutive monthly gain. Nvidia and Tesla were standouts, with the latter hitting new highs after a legal win for Elon Musk. Smaller-cap stocks also outperformed, suggesting healthy market breadth. Analysts credit persistent AI enthusiasm and solid earnings expectations as key supports despite rich valuations.

Sentiment and Positioning Tilt Bullish: Investor positioning continues to lean positive as fund managers reduce cash holdings and express confidence in further gains for 2026. While some strategists warn of overextended valuations, most year-end forecasts cluster within a narrow range, reflecting consensus optimism. Historically strong late-December seasonality could help sustain current momentum, especially if macro data remains supportive.

- Gold, Silver Set Records as Geopolitical Tensions Flare: Gold surged to an all-time high above $4,475/oz, with silver also hitting new records. The moves were driven in part by increased geopolitical tensions and a weaker U.S. dollar. The rally in precious metals may also reflect investor hedging behavior heading into the new year amid global uncertainties.

Fed Outlook, GDP Data in Focus: Fed Governor Stephen Miran reiterated the need for continued rate cuts to avoid recession risks, aligning with expectations for at least two cuts in 2026. Upcoming GDP data is expected to show resilient 3%+ growth in Q3, reinforcing the “Goldilocks” economic narrative. Still, some strategists warn that simply meeting expectations on growth and policy may not be enough to justify current equity valuations in early 2026.

S&P 500 Sector Performance

Looking Ahead

With just a handful of trading sessions left in 2025, market momentum appears intact. A seasonal tailwind, investor optimism, and relatively benign macro conditions continue to support the case for a year-end rally. However, with much good news priced in and valuations stretched, investors may want to stay nimble heading into the new year, especially as inflation, Fed policy, and earnings clarity begin to shape the 2026 narrative.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.