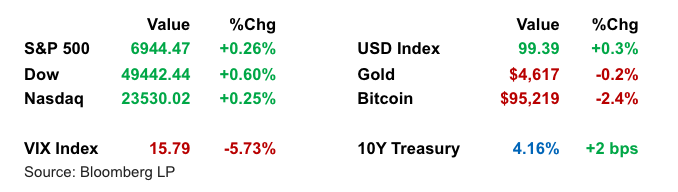

Stocks bounced back Thursday, driven by renewed AI enthusiasm following a bullish outlook from Taiwan Semiconductor (TSMC). Tech regained leadership while small caps extended their impressive run, signaling growing investor confidence in broader market participation. Stronger-than-expected macro data reinforced the soft-landing narrative, while bond yields climbed on signs of labor market resilience. Oil prices sank sharply after President Trump appeared to dial down geopolitical tensions with Iran.

Key Headlines & Market Movers:

- AI-Led Tech Rebound Anchored by TSMC: TSMC's robust 2026 capex and revenue guidance reassured investors that the AI buildout remains on solid footing. Its $56B capital plan and 30% revenue growth forecast ignited a rally across chip stocks, pushing the Philadelphia Semiconductor Index to new highs. Nvidia and ASML gained as optimism returned to the supply chain. Analysts noted the move stabilizes the recent rotation out of megacap tech rather than reversing it outright.

Small-Cap Strength Signals Broader Market Health: The Russell 2000 outperformed the S&P 500 for the 10th consecutive session, the longest streak since 1990, reflecting investor appetite for cyclical and risk-sensitive stocks. Improved breadth and more attractive relative valuations are supporting the rotation into mid- and small-cap equities. Analysts point to stronger 2026 earnings expectations as justification for continued outperformance in these segments.

- Strong Economic Data Lifts Rates: Initial jobless claims fell to a multi-month low, and New York factory activity expanded, reinforcing the narrative of a resilient U.S. economy. Treasury yields rose, with the 10-year touching 4.17%, as markets recalibrated expectations for Fed cuts. Fed officials maintained a cautious tone, reiterating the need to keep policy restrictive until inflation is more convincingly under control.

AI Policy, Capex, and Geopolitics in Focus: The U.S. struck a trade deal with Taiwan involving over $250B in chip investments on U.S. soil, paired with capped tariffs, a tailwind for domestic semiconductor infrastructure. Meanwhile, the Commerce Department’s AI chip export restrictions continue to cast uncertainty over Nvidia’s China exposure. Oil prices slid nearly 5% as Trump signaled restraint on Iran, reducing near-term geopolitical risk.

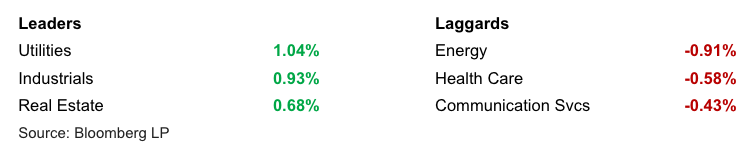

S&P 500 Sector Performance

Looking Ahead

Investors appear willing to embrace risk again, encouraged by strong corporate earnings, improving breadth, and durable macro conditions. However, with bond yields creeping higher and AI valuations still elevated, selectivity remains key. This earnings season will be pivotal in gauging how well firms can translate AI enthusiasm and economic resilience into sustainable profit growth. Continued rotation beneath the surface, both across sectors and within tech, may offer fertile ground for tactical opportunities.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.