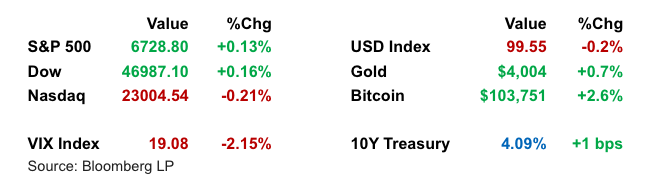

government shutdown. While the Nasdaq suffered its worst week since April, late-session buying helped lift broader markets from earlier lows. Lingering concerns about a weakening labor market, absent government data, kept investors cautious, especially in tech. Meanwhile, interest rate cut expectations for December remained intact, even without the official payrolls report.

Key Headlines & Market Movers:

- Shutdown Negotiation Progress Sparks Relief Rally: Markets turned higher in the final stretch of Friday’s session as reports suggested lawmakers were beginning to trade proposals, raising hopes for a resolution to the 38-day government shutdown. While a Senate GOP rejection dampened expectations earlier in the day, signs of movement, especially ahead of the holiday travel season, helped spark a broad equity rebound. Nearly 400 S&P 500 stocks gained on the day.

Labor Market Uncertainty Keeps Fed in Focus: With the October jobs report delayed, investors leaned on private data showing a sharp uptick in layoffs. Several large employers including Amazon, Target, and Starbucks have announced job cuts, contributing to a narrative of labor softening. Sentiment is shifting toward a December Fed rate cut, though officials remain split. The lack of government data complicates policy planning and increases market sensitivity to alternative labor signals.

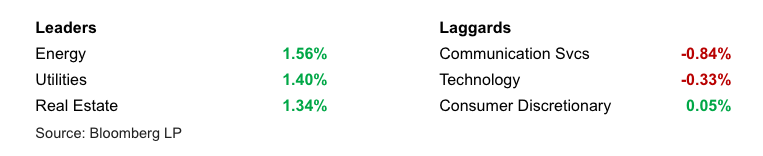

- Tech and AI Trades Face Valuation Recheck: The Nasdaq fell for a third straight week, led by weakness in mega-cap and AI-related names. Despite strong earnings from some chipmakers, the market rotated away from overextended tech trades, with names like Alphabet and Tesla under pressure. Analysts see the pullback as more of a reset than a fundamental breakdown, with investor caution growing around lofty valuations and slowing momentum.

Consumer Sentiment Hits Lows, Earnings Season Offers Cushion: Consumer confidence dipped to near record lows amid persistent inflation and the drag from the shutdown. Still, resilient earnings in broader sectors and continued inflows into equity funds provided some ballast. Names like Wendy’s outperformed as consumers traded down, while discretionary and travel-exposed companies like Six Flags and British Airways parent IAG struggled with revised guidance and weak demand.

S&P 500 Sector Performance

Looking Ahead

Next week’s focus remains on Washington, with any progress toward reopening the government likely to drive market sentiment. Investors are also eyeing corporate commentary and private data sources for clarity on labor trends in the absence of official releases. While technical indicators point to potential for a short-term bounce, risks tied to policy delays, labor softness, and valuation pressures continue to cloud the near-term outlook.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.