Markets opened the week under pressure as investors took a cautious stance ahead of Nvidia’s earnings and the delayed September jobs report, two events that could significantly influence sentiment around both AI-led growth and Fed policy. The S&P 500 snapped a lengthy technical streak, while breadth weakened and sector rotation deepened. The AI trade, once a dominant theme, is now drawing increased scrutiny, making Nvidia’s results a potential turning point. Treasury yields edged lower, the dollar gained modestly, and Bitcoin slid to a six-month low.

Key Headlines & Market Movers:

- Nvidia Earnings Seen as AI Sentiment Catalyst: Nvidia's report Wednesday is expected to be a litmus test for the broader AI narrative, which has lost momentum amid valuation concerns. While consensus expects another strong quarter, recent hedge fund 13F filings show sentiment is split. A miss or a tepid outlook could deepen the recent pullback in tech and accelerate rotation into other sectors. Nvidia shares dropped 1.8% ahead of the report, and Thiel Macro’s full exit from the name added to the tension.

September Jobs Report Could Sway Fed Cut Expectations: The delayed jobs data set for release Thursday could swing market expectations for a December rate cut, especially as recent alternative labor metrics have pointed to softness. A weak print may boost hopes for easing but also stoke growth fears, while a strong number could undermine rate-cut bets. Fed officials remain divided, with some like Waller and Jefferson leaning dovish. Yields fell slightly Monday as traders positioned cautiously.

- Technical Breakdown Raises Risk of Further Pullback: The S&P 500’s drop below its 50-day moving average broke a 138-session streak, historically a setup for near-term weakness. Strategists now eye support levels near 6,500 or even 6,150 if selling intensifies. Market breadth has deteriorated, with more than 400 S&P 500 constituents declining on Monday. Analysts suggest a period of consolidation or correction is underway following a strong six-month rally.

Alphabet Rallies on Buffett Bet as Retail Earnings Loom: Alphabet rose 3.1% to a record after Berkshire disclosed a $4.9 billion stake, boosting confidence in the stock even as tech valuations face scrutiny. Meanwhile, big-box retailers will report this week, providing another read on the consumer. Home Depot, Target, Lowe’s, and TJX all declined modestly ahead of earnings. Walmart rose slightly after announcing its CEO’s retirement, with results due Thursday.

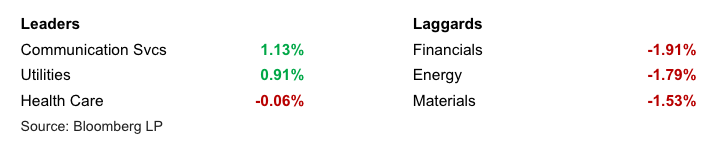

S&P 500 Sector Performance

Looking Ahead

Volatility could spike midweek as investors digest Nvidia’s results and the September jobs data. Both events carry potential to shift sentiment materially, particularly given stretched valuations and a narrowing rally. While the Fed remains cautious, markets are still leaning toward a December cut, though conviction is fragile. Traders will also keep an eye on credit spreads, which are tightening but face headwinds from rising tech debt issuance. With seasonality generally supportive in late Q4, this week may determine whether the market sees a holiday rally or a deeper pullback.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.