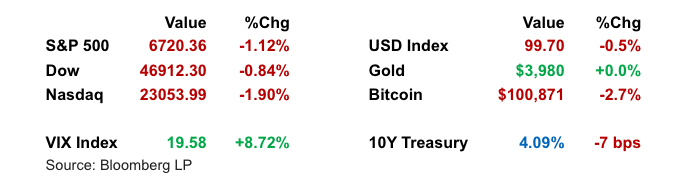

Markets reversed course Thursday as fresh signs of labor market weakness collided with renewed skepticism around stretched AI stock valuations. A sharp rise in corporate job cuts and signs of faltering hiring drove a broad risk-off tone. Mega-cap tech and crypto led the decline, while bond yields fell on growing bets that the Fed will be pushed toward further rate cuts. Despite the selloff, some analysts suggest the pullback may be a healthy reset after months of exuberance.

Key Headlines & Market Movers

- Labor Market Red Flags Shift Fed Expectations: Private-sector data filled the void left by the government shutdown, with Challenger reporting the most October job cuts since 2003, and Revelio Labs showing a drop in nonfarm jobs. While historically noisy, these figures added weight to concerns that the labor market is weakening more than expected. Treasury yields dropped sharply, and markets are now pricing in better than 60% odds of a December rate cut. Several Fed officials, however, maintained a cautious tone, emphasizing inflation risks.

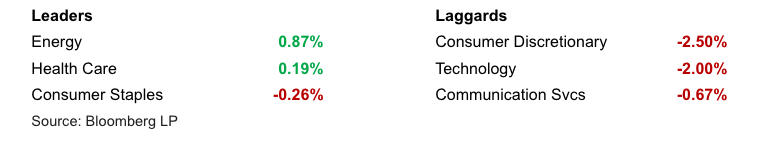

AI Stocks Drag as Valuation Fears Resurface: After a brief recovery, AI leaders retreated hard. The UBS US AI Winners Index dropped 3%, led by steep declines in Nvidia, Tesla, and Palantir. Investors are reassessing lofty expectations amid slowing macro data and a narrow leadership group driving the rally. While some view this as a necessary correction, others warn of volatility ahead, especially with key earnings still to come.

- Post-Earnings Moves Stir Volatility: Earnings reports continued to drive sharp single-stock moves. Datadog surged 23% on upbeat guidance, while DoorDash and Duolingo plunged on spending and growth concerns. Qualcomm's optimistic AI comments failed to lift its stock, suggesting investors are now more focused on execution than narratives. Snap rallied 10% on an AI partnership, showing selective enthusiasm for innovation remains.

Bond Rally and Dollar Weakness Reflect Shift in Sentiment: The 10-year Treasury yield fell to 4.09%, its biggest one-day drop in a month, reflecting increased conviction in rate cut bets. The dollar also weakened, further supporting a risk-off read on the day’s market moves. Investors rotated into fixed income as a potential safe haven, particularly as the labor outlook clouds growth expectations.

S&P 500 Sector Performance

Looking Ahead

With official economic data still delayed by the shutdown, markets will remain sensitive to alternative indicators and Fed commentary. The labor market is becoming a more central concern for policy direction, particularly as inflation pressures show signs of persistence. Investors are watching Nvidia’s earnings later this month as a potential inflection point for the AI trade. Meanwhile, fixed income and equity income strategies may gain traction as markets navigate heightened volatility and slower growth expectations.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.