After briefly touching fresh highs, U.S. equities reversed course Tuesday as investor optimism around softer inflation faded and JPMorgan’s earnings fell short of expectations. The S&P 500, Nasdaq, and Dow all ended lower, with financials dragging and a lack of conviction around near-term Fed rate cuts weighing on sentiment. Bonds held steady while the dollar firmed. Tech chipmakers bucked the trend, helping limit broader downside.

Key Headlines & Market Movers:

- CPI Data Cools But Doesn’t Move the Needle on Fed Cuts: December’s core CPI rose 0.2% month-over-month and 2.6% year-over-year, below forecasts and matching a four-year low. While a welcome sign that inflation isn’t reaccelerating, the data wasn’t enough to shift the Fed’s projected path. Markets continue to expect the next cut no earlier than mid-year. With labor markets still relatively strong and inflation just above target, the Fed appears in no rush to ease further.

JPMorgan Leads Bank Earnings Lower: JPMorgan shares fell over 4% after Q4 results missed on investment banking revenue. Despite an earnings beat, weak advisory and underwriting volumes weighed on results. The broader group, including Bank of America, Citigroup, and Goldman Sachs, reports later this week. Banks are expected to post their second-highest annual profit ever, but elevated rate and regulatory uncertainty may cap upside.

- Political and Policy Noise Adds Market Jitters: Headlines around potential SCOTUS rulings on tariffs, the Justice Department probe into Fed Chair Powell, and President Trump’s renewed pressure on credit card rates have all added layers of uncertainty. Trump’s tariff threats, particularly around Iran, also boosted oil prices and increased geopolitical tensions, creating additional market crosscurrents for investors to monitor.

Earnings Season Kickoff Highlights High Bar for Tech: Investor focus is shifting toward corporate earnings, with Big Tech expected to be the primary driver of Q4 growth. Chipmakers Intel and AMD surged after analyst upgrades, highlighting enthusiasm around AI and server demand. However, with valuations elevated, companies will need to not only beat earnings but also raise guidance to sustain momentum.

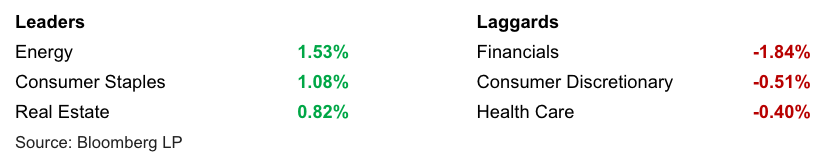

S&P 500 Sector Performance

Looking Ahead

With CPI now behind us, market attention will turn squarely to earnings season and Fed communication. While inflation is cooling, stronger labor market data and persistent policy uncertainty suggest the Fed will remain on hold at the January meeting. Expect volatility around major bank and tech earnings, as well as any additional developments from Washington or global geopolitical flashpoints. The backdrop remains constructive but fragile. Investors will be looking for clarity from corporate America in the weeks ahead.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.