Markets Waver as Valuation Fears Resurface: Tech and Crypto Lead Broad Pullback

Stocks fell sharply Tuesday as a string of warnings from major Wall Street executives reignited concerns about stretched valuations, particularly in tech and AI-driven names. Despite strong earnings and resilient economic conditions, sentiment turned risk-off as investors grew cautious about the narrowness of recent gains. The S&P 500 and Nasdaq saw notable declines, and crypto markets tumbled, while Treasury yields eased and the dollar strengthened.

Key Headlines & Market Movers

- Wall Street Sounds the Alarm on Valuations: A chorus of high-profile executives, including leaders from Goldman Sachs, Capital Group, and Morgan Stanley, called for caution amid growing signs of market froth. The concern centers on elevated valuations, especially in AI-linked tech names, and a rally increasingly concentrated in a small group of stocks. Strategists across firms suggested a pullback is healthy and perhaps overdue, with some comparing current dynamics to the late 1990s tech bubble.

Tech Rout Underscores Fragile Leadership: Mega-cap tech and AI names led Tuesday’s declines. Palantir fell 8% despite raising guidance, weighed down by valuation concerns and bearish bets from Michael Burry. Nvidia, AMD, and Tesla also sold off, while Micron and Intel dropped 7% and 6%, respectively. With the Nasdaq down over 2%, the reversal highlights how dependent the broader rally has become on a narrow slice of the market, and how quickly sentiment can shift.

- Risk-Off Sentiment Hits Crypto and Commodities: Bitcoin tumbled nearly 6%, briefly dipping below $100,000 as speculative assets took the brunt of the selloff. Ether plunged 11%. Gold fell 1.6% and oil prices also retreated, despite strong earnings from BP and Saudi Aramco. The dollar strengthened, reflecting a flight to safety amid the tech-led pullback and renewed caution about near-term equity prospects.

Earnings Recap - Strength Meets Selective Reaction: Corporate results were generally strong, but investor reactions were highly selective. Hertz spiked 36% on cost-cutting success, while Marriott gained 3% on solid results. In contrast, Uber fell 5% on legal charges, and Norwegian Cruise Line sank 15% despite earnings, dragging peers lower. Sarepta Therapeutics dropped 33% after disappointing trial results, while Denny’s surged 50% on buyout news. These divergent moves underscore a more discerning market mood.

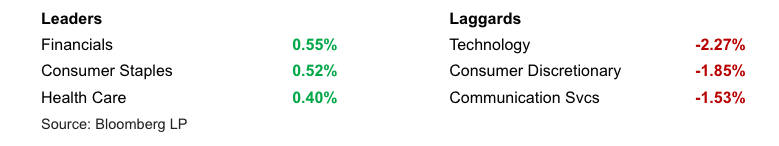

S&P 500 Sector Performance

Looking Ahead

The recent pullback may mark the start of a consolidation phase, as investors digest gains from one of the strongest six-month stretches in decades. While the medium-term outlook remains constructive, supported by earnings strength, easing policy, and AI optimism, short-term risks are rising. Market breadth remains a key watchpoint, and dips may present selective buying opportunities for long-term investors, but caution is warranted. As always in late-cycle rallies, discipline will matter more than momentum.

Disclaimer

Duncan Williams Asset Management is an SEC registered investment adviser. SEC registration does not constitute an endorsement of Duncan Williams Asset Management by the SEC nor does it indicate that Duncan Williams Asset Management has attained a particular level of skill or ability.

This material prepared by Duncan Williams Asset Management is for informational purposes only and is accurate as of the date it was prepared. It is not intended to serve as a substitute for personalized investment advice or as a recommendation or solicitation of any particular security, strategy or investment product. Past performance is not indicative of future results. Investing involves risks, including the risk of loss of principal. Before making any investment decision, investors should consult with their financial advisor, consider their individual financial circumstances, and carefully review all relevant information and risk factors. Duncan Williams Asset Management assumes no responsibility for errors or omissions, nor does it accept liability for any loss arising from reliance on this information.

Advisory services are only offered to clients or prospective clients where Duncan Williams Asset Management and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Duncan Williams Asset Management unless a client service agreement is in place.

This material is not intended to serve as personalized tax, legal and/or investment advice since the availability and effectiveness of any strategy is dependent upon your individual facts and circumstances. Duncan Williams Asset Management is not a legal or accounting firm. Please consult with your legal or tax professional regarding your specific tax situation when determining if any of the mentioned strategies are right for you.