Where to Park Emergency Cash in Today’s Rate Environment: Comparing High Yield Savings, Money Market Funds, and Short Term Treasuries

These days, the smartest place for emergency cash is in accounts or funds that keep your money safe, let you access it quickly, and still offer a solid yield. That usually means spreading your cash across high-yield savings, money market funds, and short-term Treasuries, instead of relying on just one. The best mix for you will depend on how soon you might need the cash, how comfortable you are with minor ups and downs in value, and whether your emergency fund is in a regular or tax-advantaged account.

What “Emergency Cash” Needs To Do

For true emergency funds, the priority order is typically:

- Capital preservation first: Avoid meaningful risk of loss over short horizons.

- Liquidity and access: Ability to reach cash quickly without penalties or complex trades.

- Reasonable yield: Take advantage of today’s higher short‑term rates without stretching for risk.

Right now, high-yield savings, money market mutual funds (which are governed by SEC rules), and short-term U.S. Treasury bills all check these boxes, but each does it in a slightly different way.

High‑Yield Savings Accounts

Online high-yield savings accounts at FDIC- or NCUA-insured banks are offering up to 5% APY as of mid-January 2026—a huge jump compared to the national average of just 0.4%. These accounts are made for easy transfers to your checking account, so they're a strong fit for emergency funds.

Pros

- FDIC/NCUA insurance, typically up to $250,000 per depositor, per insured institution, enhances safety.

- Stable account value (no market price fluctuation) and typically no minimum holding period.

- Same‑bank transfers can be instant; external ACH transfers usually settle within 1–3 business days.

Cons

- Rates are variable and can be cut quickly as market rates fall.

- Some accounts impose transaction limits, delays on large withdrawals, or require certain behaviors to earn top APYs.

- Interest is fully taxable as ordinary income at the federal level and, in most states, at the state level.

Money Market Mutual Funds

Money market mutual funds spread your cash across a variety of short-term investments like T-bills, top-quality commercial paper, and repurchase agreements. These funds are tightly regulated for safety and liquidity. Government and Treasury money market funds stick mainly to U.S. government-backed securities, while prime funds can include some highly rated short-term corporate debt too.

Pros

- Designed to maintain a stable $1 net asset value, subject to market and liquidity conditions.

- Rule 2a‑7 requires conservative maturities, credit standards, and minimum daily and weekly liquidity to help funds meet redemptions.

- Yields often track short‑term market rates closely and can be competitive with, or higher than, many savings accounts in a rising rate environment.

Cons

- Not bank deposits and not insured by the FDIC; principal is not guaranteed, and funds can “break the buck” in extreme conditions.

- Certain institutional and prime funds may impose liquidity fees or other measures if liquidity thresholds are breached under Rule 2a‑7 reforms.

- Access is typically via brokerage platforms; settlement timing and cut‑off times can affect same‑day liquidity.

Short‑Term U.S. Treasuries (T‑Bills)

Short-term U.S. Treasury bills (T-bills) are about as safe as it gets, since they're backed by the U.S. government. You can choose maturities from just a few weeks up to a year, which makes it easy to match your cash needs to a timeline. You can buy T-bills through TreasuryDirect or a brokerage, often in chunks as small as $100 or $1,000.

Pros

- Very high credit quality and minimal default risk, backed by the U.S. government.

- Yields on 3‑month and similar T‑bills have recently been competitive with other short‑term instruments, providing attractive income for parking cash for a few months.

- Interest on Treasuries is taxable at the federal level but typically exempt from state and local income tax, which can benefit residents of higher‑tax states.

Cons

- Funds are locked until maturity unless bills are sold in the secondary market, where prices can fluctuate with interest rates.

- Accessing cash quickly may require selling through a brokerage and waiting for trade settlement.

- For very short‑notice emergencies, the transaction steps and timing may be less convenient than a bank savings transfer.

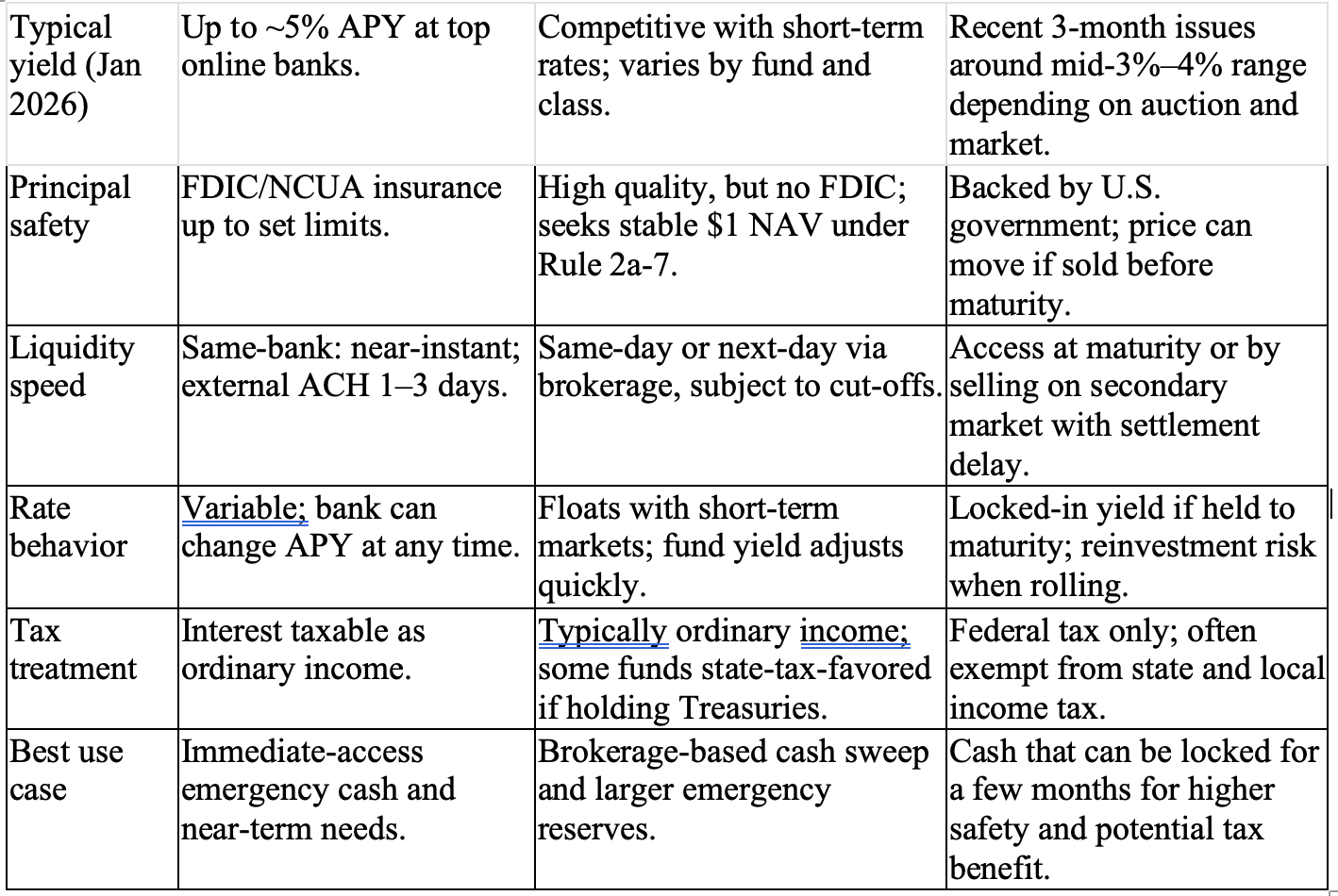

How These Choices Compare

The table below summarizes key characteristics of the three main options in today’s environment.

For most people, a practical strategy is to keep some emergency cash in a high-yield savings account for quick access, put some in a conservative government or Treasury money market fund through a brokerage, and, if you don’t think you’ll need the money for a while, consider building a ladder of short-term T-bills for extra yield.

Disclosure

This article is provided for general informational and educational purposes only and does not constitute individualized investment, tax, or legal advice, a recommendation to buy or sell any security, or a solicitation of any offer to buy or sell securities. Investments in money market mutual funds, including government and Treasury money market funds, are not insured or guaranteed by the FDIC or any other government agency, and it is possible to lose money by investing in these funds. Past performance, including prevailing interest rates or yields mentioned for high‑yield savings accounts, money market funds, or U.S. Treasuries, is not a guarantee of future results, and yields are subject to change at any time. Any references to specific products, platforms, or yield levels are illustrative and may not represent all available options or current market conditions at the time you read this. Consider your individual financial situation, risk tolerance, and time horizon, and consult a qualified financial professional before making any investment or savings decisions.

Nothing in this article is intended to, and does not, constitute a recommendation by a registered investment adviser or broker‑dealer as defined under U.S. securities laws, nor should it be interpreted as a research report under applicable SEC and FINRA rules. Descriptions of money market funds and Rule 2a‑7 are based on publicly available regulatory materials and may omit certain technical details; investors should review a fund’s prospectus and the full text of SEC rules before investing. Bank and credit union deposit insurance limits are set by federal regulation and may change; investors should confirm current coverage limits and institution status with the FDIC or NCUA. This content is not tailored to the investment needs of any specific person, and no reliance should be placed on it as the primary basis for any investment decision.

Sources

- High‑yield savings rate examples and commentary: https://fortune.com/article/best-savings-account-rates-1-16-2026/

- Additional high‑yield savings context: https://fortune.com/article/best-savings-account-rates-1-12-2026/

- High‑yield savings account overviews: https://www.bankrate.com/banking/savings/best-high-yield-interests-savings-accounts/

- High‑yield savings for emergency funds: https://finance.yahoo.com/personal-finance/banking/article/best-high-yield-savings-account-171334498.html

- High‑yield savings account round‑up and rate examples: https://www.investopedia.com/high-yield-savings-accounts-4770633

- SEC Rule 2a‑7 overview: https://www.investopedia.com/articles/mutualfund/10/a-safer-money-market-2a7.asp

- Text of SEC Rule 2a‑7: https://www.law.cornell.edu/cfr/text/17/270.2a-7

- SEC money market fund reform summary: https://www.ropesgray.com/en/insights/alerts/2023/07/sec-adopts-money-market-fund-reforms-and-changes-to-reporting-requirements

- Money market liquidity requirements summary: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/mutual-funds/understanding-liquidity-in-money-market-mutual-funds.pdf

- Short‑term investment and T‑bill overview: https://districtcapitalmanagement.com/best-short-term-investments/

- T‑bill characteristics and strategy guide: https://www.historicfinancialnews.com/finance-term/t-bill

- Recent Treasury yield example and purchase mechanics: https://public.com/bonds/treasury/united-states/ust-0.0-01-22-2026-912797pd3